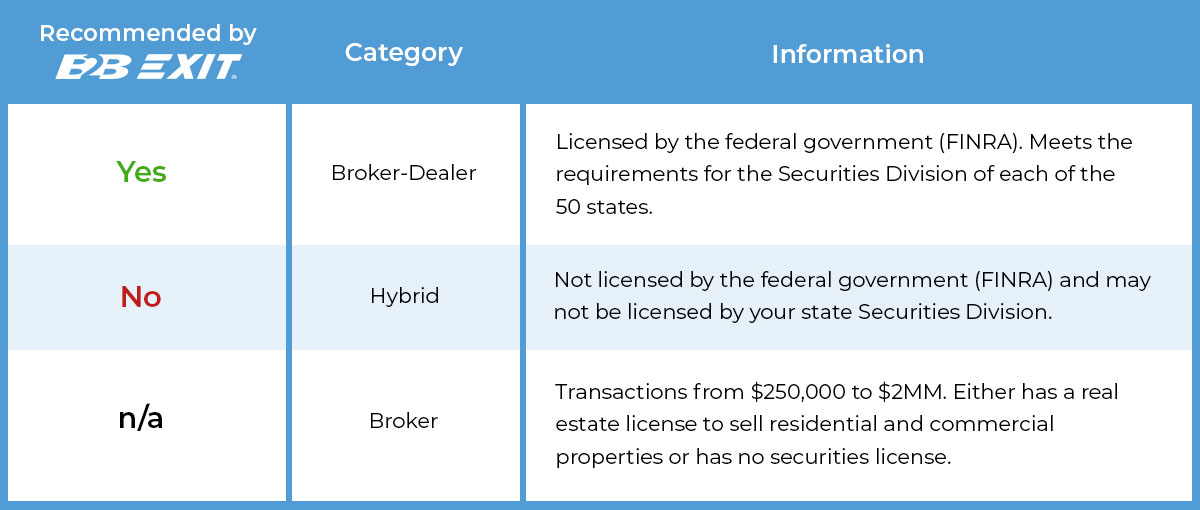

B2B EXIT® recommends that our clients work exclusively with FINRA licensed, bonded and regulated broker-dealers to assist with the sale of their companies. Their main role on the Success Team is to find qualified buyers. We expect sage advice from these broker-dealers as our clients go through the process.

The Financial Industry Regulatory Authority (FINRA) is a private American corporation that acts as a self-regulatory organization (SRO) that regulates member brokerage firms and exchange markets. The U.S. government agency that acts as the ultimate regulator of the U.S. securities industry, including FINRA, is the U.S. Securities and Exchange Commission (SEC).

B2B EXIT® is often a referral source for broker-dealers. We are frequently used in the interview process. For clarification, we do not recommend Hybrids, which are companies that promote themselves as M&A firms but are not licensed by the federal government. Worst, they may not be licensed by the individual state Securities Division, which often have regulatory requirements that are stricter than the federal government. (While the SEC regulates and enforces the federal securities laws, each state has its own securities regulator who enforces what are known as “blue sky” laws.) Caveat Emptor!

Hiring the professionals to help sell or acquire a business can be confusing due to the numerous titles they use on their websites and advertisements. Some of the titles used are correct but some are misleading, such as; Investment Banker, M&A Company, M&A Advisors, M&A Firm, etc. This page has information that is critical for business owners in their hiring process.

Payment of Referral Fees (Kickbacks)

Search – Hire a very talented person/company to do an internal search on the company you are considering to hire. Ask for information on public complaints, civil litigation, criminal matters or misdemeanors that are investment-related or involve theft or a “breach of trust.”